When you start to look for help with your finances, whom do you ask first? Your best friend, parents, or a banker? By asking for a financial planner first, you are more likely to keep more of your money, save your time, and reduce your financial risks to help you reach your goals.

Here are my three favorite reasons you should look for and hire a financial planner:

- Increased Financial Confidence

- Accountability of Actions

- Advancing Your Financial Literacy

Before I dive into these three reasons, I need to acknowledge that there seems to be some serious confusion for most of the Canadian public about who is advising them and what a financial planner is. Most people either don’t understand or don’t have enough information about who is advising them on their financial matters. This is an especially difficult task as everyone will have a slightly different experience with an advisor, given the advisor’s level of experience, education, skill, registration requirements, ethical requirements, personal biases, employment requirements and specialization within the industry.

The complexity in the industry, with slight differences between advisor titles, is staggering. You may be meeting with a financial adviser, financial advisor, investment advisor, portfolio manager, investment counsellor, financial consultant and wealth coach among others. They may each do different things, target different niches, and/or specialize in different areas but may not actually provide financial planning services. Adding to the complexity is the lack of legislation for the term financial planner in all provinces except for Quebec.

“There is no legislated standard in place for financial planners or for those who offer financial planning services. In fact, in every Canadian province except Quebec, people may call themselves financial planners without having any credentials or qualifications whatsoever” – Financial Planning Standards Council.

I bring this up because I want to be clear that people looking for financial advice should look to hire and pay for the right type of financial advice. This is in the form of Certified Financial Planning professionals (CFP®) registered with the Financial Planning Standards Council (FPSC, now called FP Canada) and/or Registered Financial Planners (R.F.P.) from the Institute of Advanced Financial Planners (IAFP). These are the people I call financial planners with a nod to the IAFP for placing a higher level of ethical and planning experience requirements upon registrants.

I understand how valuable it can be when you meet the right advisor and get the right advice. Yet the value of financial planning has been described as incredibly difficult to quantify and you may see it as a secondary benefit and a waste of money or time. After all, there is great information on the internet, and your parents, best friend, banker etc. must know how best to help you, right?

Without further ado, here are my top reasons you should look to hire a financial planner instead:

1.) Increased Confidence – Know your WHOLE picture

The statistics speak loudly:

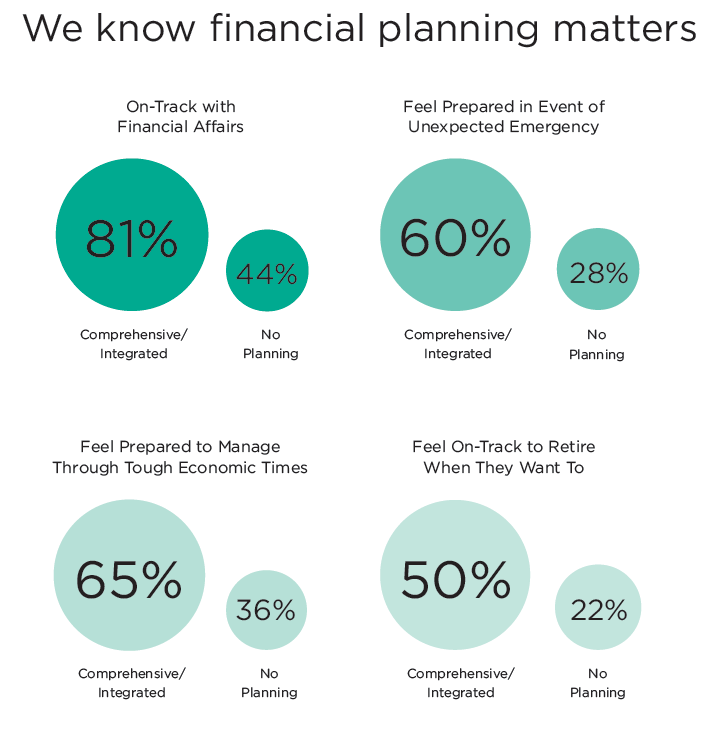

Utilizing the FPSC’s most recent survey is maybe the best way to quantify how financial planning can increase levels of confidence. People feel much more on track with their financial affairs than compared to those without a financial plan.

Let’s look at an example of someone looking to plan their retirement. In preparation, a person must understand not only that they have enough money to last through their retirement but go through a laundry list of to-do items and complex decisions to make. Just to list a few:

a.) When to take CPP/OAS

b.) When best to turn an RRSP or LIRA into a RRIF or LIF

c.) How to avoid or reduce the OAS claw-back

d.) How to sell a business or real estate in a tax efficient way

e.) DB pension vs. Commuting decisions

f.) Insurance needs in retirement

g.) When to take less risk with investments in retirement and look for more of a ‘guarantee’

Typically, most people want to understand how much they can spend in retirement. I’ve seen far too many retirees worry about paying too much tax and limit their withdrawals to fund their lifestyle to avoid the next tax bracket. I’ve also seen too many people living solely on government benefits and have nothing to leave to their beneficiaries.

Another common issue we see is that a retiree will delay their retirement for a couple of years in a downturn until markets recover. If they had set a plan for retirement a couple of years prior, a potential recommendation could have been to hold a little bit more cash to ride out the volatility.

A financial planner can help you make logical and sensible decisions for your retirement. Knowledge is power and financial confidence is in the knowledge that you are making the best possible financial decision for your financial situation.

2.) Accountability of Actions

When it comes to financial planning and specifically investment management, the more you know about your own personal biases and can learn from past errors in judgement and avoid future bad decisions, the more money you can make. There is a whole subject matter writing on this called behavioural investing.

“To Err is humane…” – 18th century poet Alexander Pope

Canadian’s have a special familiarity bias towards investing in the Canadian stock market as if it’s consistently one of the biggest and best economies in the world. What we know best is usually what we are most comfortable investing in. My experience in Calgary leads me to believe that most Calgarians favor oil and gas company stocks as their livelihoods usually revolve around the oil and gas industry. The risks of this bias are evident when you review the volatility of oil prices, especially over the last 4 years, and compare it to the other available investment markets.

When we look at our daily spending habits and monetary decision making, we can step back and recognize where these decisions may be coming from. How the brain thinks about money is in the same central part of the brain, the Limbic System, that controls pain and pleasure responses, fight or flight responses, and short-term learning. There is an entire field of study on this called neuroscience. Recognizing this and training your brain to make smarter daily money decisions can be difficult.

“It’s not your salary that makes you rich, it’s your spending habits.” – Charles A Jaffee

Knowing our money decisions are sometimes made from an irrational part of the brain is a great reason to hire a financial planner. Accountability to your actions using a financial planner’s logic and reason can act as a buffer against your personal investment bias and spending habits.

3.) Advancing Your Financial Literacy

I’ve been a CFP® professional for over a decade now and have taken thousands of clients through the financial planning process. After the results from the plan have been presented, it’s amazing to me how many times my clients have said: “I can’t believe they don’t teach this stuff in school”.

“The number one problem in today’s generation and economy is the lack of financial literacy” – Alan Greenspan

To me, basic financial planning (cash flow management, credit management, basic investment understanding, understanding financial risks) is an important, life-altering skill. It should be taught in school just like any other basic subject on life planning.

The Alberta Securities Commission, the principal regulator in Alberta, has an entire section on financial literacy: http://www.checkfirst.ca/financial-literacy/

While doing your own research and increasing your basic financial literacy is an important step, employing a professional financial planner is a vital part of the process. Much like understanding the basics on how to live a healthy life, such as eating right and staying active, are important, seeing a Doctor when there is a health issue or going a checkup is a vital step.

Other important advisors in your financial life may be:

- Chartered Professional Accountants – for proper tax planning/preparation and business advice

- Personal/Corporate Lawyers – to help you with legal advice and estate planning

- Investment Counsellor or Portfolio Manager – to help you manage your investment portfolio

- Insurance broker – to help you with risk management products

- Banker – to help you manage your daily cash and borrowing needs

They are all important and necessary in various situations, but they should not be relied upon to provide a holistic look at your entire financial picture and create a comprehensive financial plan. Only a financial planner has the expert knowledge in all these financial areas to help tie your plan together to ensure it makes sense for you.

So, what does a comprehensive financial plan look like?

“Planning is bringing the future into the present so that you can do something about it now.” – Alan Lakein

A comprehensive financial plan looks at your whole picture in a 6-step process. Here it is supplied by the IAFP:

This process usually includes the following services:

- Cash flow management and advice

- Investment allocation advice or management

- Insurance needs analysis

- Estate and risk planning

- Tax efficiency

- Education planning

- Corporate planning

- Retirement projections

- Trust planning

A proper financial plan shouldn’t be used to simply sell you a product or service. It should outline all the potential solutions, with the positives and negatives, based on your personal goals. This is the best way to ensure you are getting a financial education along with making an informed choice about your financial future.

“…something magical happens when you write down your goals. It changes the way you see your situation.” – Dave Ramsey

Imagine the confidence you’d have walking into a meeting with an insurance sales agent with a full understanding of your life, disability, long term care, and critical illness risks and options. You wouldn’t be oversold on something you don’t need and leave confidently that you’ve bought the right product. Same thing for a buying a new car, financing a home purchase, buying into a business or making an investment decision.

Imagine always having someone you can call up and discuss any given financial decision. By hiring a financial planner, you now have an expert in all areas of finance in your back pocket. This could be invaluable!

If you’d like to know more and understand how a comprehensive financial plan combined with discretionary portfolio management can benefit your personal situation, connect with RT Mosaic Wealth Management Ltd. today.

Disclaimer

This post should not be construed or interpreted to be investment advice or direct financial planning advice. Any data, information and content on this blog is for information purposes only and should not be construed as an offer of advisory services. Related information is presented ‘as is’ and does not make any express or implied warranties, representations or endorsements whatsoever with regard to any products or service. It is solely your responsibility to evaluate the accuracy, completeness and usefulness of all opinions and information provided. This post does not warrant and makes no representations about the accuracy, reliability, completeness or timeliness of the content, be error-free or that defects in the information will be corrected. The law is constantly changing, and your situation should always be consulted with the proper professional. All links and images have been cited and are owned by those individuals under their individual sites.

This post was written by IAFP member David Miller BFS, CFP®, R.F.P., CIM®. David is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. David has been providing advice to high net worth and affluent individuals and families for over 10 years and prides himself on helping growing families and retirees get organized, focus more on their priorities, and make smarter decisions with objective recommendations.