Key takeaway

- Uncertainty is a constant, and downturns happen frequently. But market setbacks have typically been followed by recoveries.

- Stay disciplined: Trying to time the market has proven challenging–and could cost you.

- Plan for a variety of markets: An investing approach built with your goals and situation in mind may help you cope with short-term volatility.

- Consider help: Work with your advisor to determine a strategy that fits your risk tolerance.

Triggers for market volatility can come in many different shapes and sizes–policy uncertainty in Washington, earnings reports, geopolitical unrest, the list is almost endless. And market swings can rattle even seasoned investors’ nerves. But volatility is part and parcel of investing.

“Dramatic moves in the market may cause you to question your strategy and worry about your money,” says Ann Dowd, CFP®, vice president at Fidelity Investments. “A natural reaction to that fear might be to reduce or eliminate any exposure to stocks, thinking it will stem further losses and calm your fears, but that may not make sense in the long run.”

Instead of being worried by volatility, be prepared. A well-defined investing plan tailored to your goals and financial situation can help you be ready for the normal ups and downs of the market, and to take advantage of opportunities as they arise.

“Market volatility should be a reminder for you to review your investments regularly and make sure you consider an investing strategy with exposure to different areas of the markets–U.S. small and large caps, international stocks, investment-grade bonds–to help match the overall risk in your portfolio to your personality and goals,” says Dowd.

Here’s how:

1. Keep perspective–downturns are normal and normally short lived

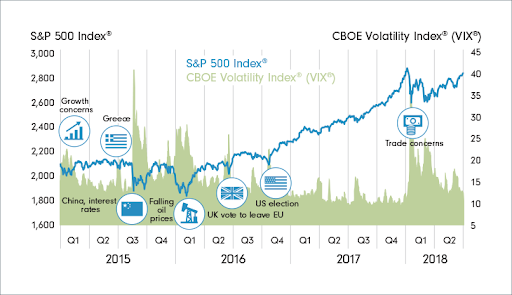

Market downturns may be upsetting, but history shows that the stock market has been able to recover from declines and can still provide investors with positive long-term returns. Since mid-2015, this general pattern played out. U.S. stocks experienced sharp drops in Q3 2015, when China devalued its currency; in Q1 2016, as oil prices dropped; in Q2 2016, after the “Brexit” vote; in the run-up to the 2016 US presidential election; and in 2018, concerns about trade rattled investors. Still, during the 3-year period, the market was up more than 30% cumulatively.

Volatility is a normal part of investing

Past performance is no guarantee of future results. The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation. S&P and S&P 500 are registered service marks of Standard & Poor’s Financial Services LLC. The CBOE Volatility Index is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. You cannot invest directly in an index

2. Be comfortable with your investments

If you are nervous when the market goes down, you may not be in the right investments. Your time horizon, goals, and tolerance for risk are key factors in helping to ensure that you have an investing strategy that works for you.

Even if your time horizon is long enough to warrant an aggressive portfolio, you have to be comfortable with the short-term ups and downs you’ll encounter. If watching your balances fluctuate is too nerve-racking for you, consider working with your advisor to reevaluate your investment mix to find one that feels right.

But be wary of being too conservative, especially if you have a long time horizon, because strategies that are more conservative may not provide the growth potential you need to achieve your goals. Set realistic expectations too. That way, it may be easier to stick with your long-term investing strategy. Choose the amount of stocks you are comfortable with.

3. Do not try to time the market

Attempting to move in and out of the market can be costly. Research studies from independent research firm Morningstar show that the decisions investors make about when to buy and sell funds cause those investors to perform worse than they would have had the investors simply bought and held the same funds.1

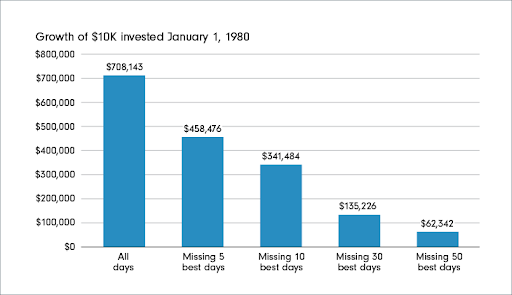

If you could avoid the bad days and invest during the good ones, it would be great–the problem is, it is impossible to consistently predict when those good and bad days will happen. And if you miss even a few of the best days, it can have a lingering effect on your portfolio.

Trying to time the market can cost you

Past performance is no guarantee of future results. The hypothetical example assumes an investment that tracks the returns of the S&P 500® Index and includes dividend reinvestment but does not reflect the impact of taxes, which would lower these figures. There is volatility in the market, and a sale at any point in time could result in a gain or loss. Your own investing experience will differ, including the possibility of loss. You cannot invest directly in an index. The S&P 500®Index, a market capitalization‐weighted index of common stocks, is a registered trademark of The McGraw-Hill Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation. Source: FMRCo, Asset Allocation Research Team, as of June 29, 2018.

4. Invest regularly, despite volatility

If you invest regularly over months, years, and decades, short-term downturns will not have much of an impact on your ultimate performance. Instead of trying to judge when to buy and sell based on market conditions, if you take a disciplined approach with an advisor to make investments weekly, monthly, or quarterly, you can avoid the perils of market timing.

If you keep investing through downturns, it won’t guarantee gains or that you will never experience a loss, but when prices do fall you may actually benefit in the long run. When the market drops, the prices of investments fall and your regular contributions allow you to buy a larger number of shares.

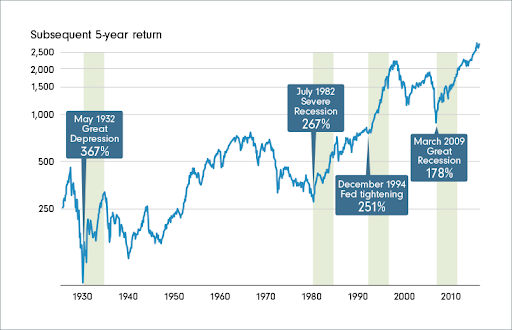

In fact, what seemed like some of the worst times to get into the market turned out to be the best times. The best 5-year return in the U.S. stock market began in May 1932–in the midst of the Great Depression. The next best 5-year period began in July 1982, amid an economy in the midst of one of the worst recessions in the postwar period, featuring double-digit levels of unemployment and interest rates.

It has paid to stay invested in US stocks during troubled times

US stock market returns represented by total return of S&P 500® Index. Past performance is no guarantee of future results. It is not possible to invest in an index. First 3 dates determined by best 5-year market return subsequent to the month shown. Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team as of July 1, 2018.

5. Take advantage of opportunities

There may be a few actions that you can take with your advisor while the markets are down to help put you in a better position for the long term. For instance, if you have investments you are looking to sell, a downturn may provide the opportunity for tax-loss harvesting–when you sell an investment and realize a loss. That could help your tax planning.

Finally, if the movement of the markets has changed your mix of large-cap, small-cap, foreign, and domestic stocks, or your mix of stocks, bonds, and cash, you may want to work with your advisor and rebalance to get back to your plan. That could provide a disciplined approach that helps you take advantage of lower prices.

6. Consider a hands-off approach

To help ease the pressure of managing investments in a volatile market, work with your advisor to determine a strategy that fits your risk tolerance.

The bottom line

Rather than focusing on the turbulence, wondering whether you need to do something now or wondering what the market will do tomorrow, it makes more sense to focus on developing and maintaining a sound investing plan with your advisor. A good plan will help you ride out the peaks and valleys of the market and may help you achieve your financial goals.

1. Morningstar, Mind the Gap 2018.

This article was originally published on the Fidelity.ca website